Master Your Financials with Effective Construction Accounting Strategies

Wiki Article

Exploring the Value of Construction Audit in the Building Market

The construction sector runs under distinct financial obstacles that demand a customized method to accountancy. Building and construction accountancy not just makes certain the accuracy of financial coverage however also plays a pivotal role in job administration by enabling reliable job costing and resource appropriation. By comprehending its essential concepts and benefits, stakeholders can considerably affect job results. Nevertheless, the intricacies inherent in building and construction accountancy raising inquiries about best practices and the devices offered to handle these details efficiently. What strategies can building and construction companies apply to optimize their financial procedures and drive success?Distinct Difficulties of Building And Construction Audit

Often, building and construction accounting provides distinct difficulties that distinguish it from other fields. One key obstacle is the complicated nature of building jobs, which commonly involve numerous stakeholders, rising and fall timelines, and differing regulations. These variables necessitate precise tracking of prices related to labor, materials, equipment, and overhead to keep task productivity.An additional considerable difficulty is the demand for exact work costing. Construction business should designate expenses to specific tasks precisely, which can be hard as a result of the lengthy period of tasks and the potential for unexpected expenses. This requirement needs durable accounting systems and practices to guarantee prompt and specific economic reporting.

Additionally, the construction industry is susceptible to change orders and agreement alterations, which can additionally make complex economic monitoring and forecasting. Appropriately making up these modifications is vital to ensure and prevent disagreements that tasks remain within budget plan.

Secret Concepts of Building And Construction Accounting

What are the foundational principles that lead building accounting? At its core, construction audit revolves around accurate tracking of expenses and earnings connected with particular projects. The initial concept is the use of task costing, which makes sure that all expenses connected to a task-- labor, products, overhead-- are meticulously documented and assigned. This permits accurate success evaluation at the task level.Another key principle is the application of the percentage-of-completion method. This approach acknowledges revenue and expenses proportionate to the job's development, giving an extra practical view of financial performance gradually. Furthermore, construction bookkeeping emphasizes the significance of compliance with accountancy requirements and policies, such as GAAP, to make certain openness and integrity in financial reporting.

Furthermore, money flow management is vital, given the often intermittent nature of construction jobs. These concepts collectively form a robust framework that sustains the distinct monetary needs of the construction market.

Benefits of Reliable Building And Construction Bookkeeping

Efficient building accounting gives numerous benefits that considerably enhance the total management of projects. my company Among the key benefits is enhanced monetary visibility, allowing project supervisors to track costs properly and monitor cash money flow in real-time. This openness facilitates notified decision-making, reducing the risk of budget plan overruns and making sure that sources are designated efficiently.Furthermore, efficient building and construction accountancy boosts compliance with regulatory demands and market requirements. By keeping precise financial records, companies can conveniently give paperwork for audits and meet contractual commitments. This diligence not only cultivates trust with clients and stakeholders but additionally minimizes possible lawful risks.

Furthermore, effective accountancy techniques add to far better job forecasting. By examining previous efficiency and economic fads, building companies can make even more accurate predictions regarding future project costs and timelines. construction accounting. This capability enhances tactical preparation and allows business to react proactively to market fluctuations

his explanation

Tools and Software Program for Building Accounting

A variety of specialized devices and software application solutions are offered for building accounting, each created to streamline monetary management processes within the sector. These devices assist in monitoring, reporting, and assessing monetary data certain to building tasks, making sure accuracy and compliance with market criteria.Leading software choices include integrated construction monitoring systems that encompass job accountancy, budgeting, and monitoring capabilities. Solutions such as Sage 300 Building And Construction and Genuine Estate, copyright for Contractors, and Viewpoint Vista deal features customized to take care of work setting you back, payroll, and invoicing, allowing construction companies to maintain exact monetary oversight.

Cloud-based applications have actually gained appeal because of their accessibility and real-time cooperation capabilities. Tools like Procore and CoConstruct enable teams to accessibility monetary data from several places, enhancing interaction and decision-making procedures.

Additionally, construction accountancy software program frequently sustains conformity with governing needs, assisting in audit tracks and tax coverage. The integration of mobile applications additional improves functional efficiency by permitting area employees to input information straight, reducing errors and hold-ups.

Best Practices for Construction Financial Monitoring

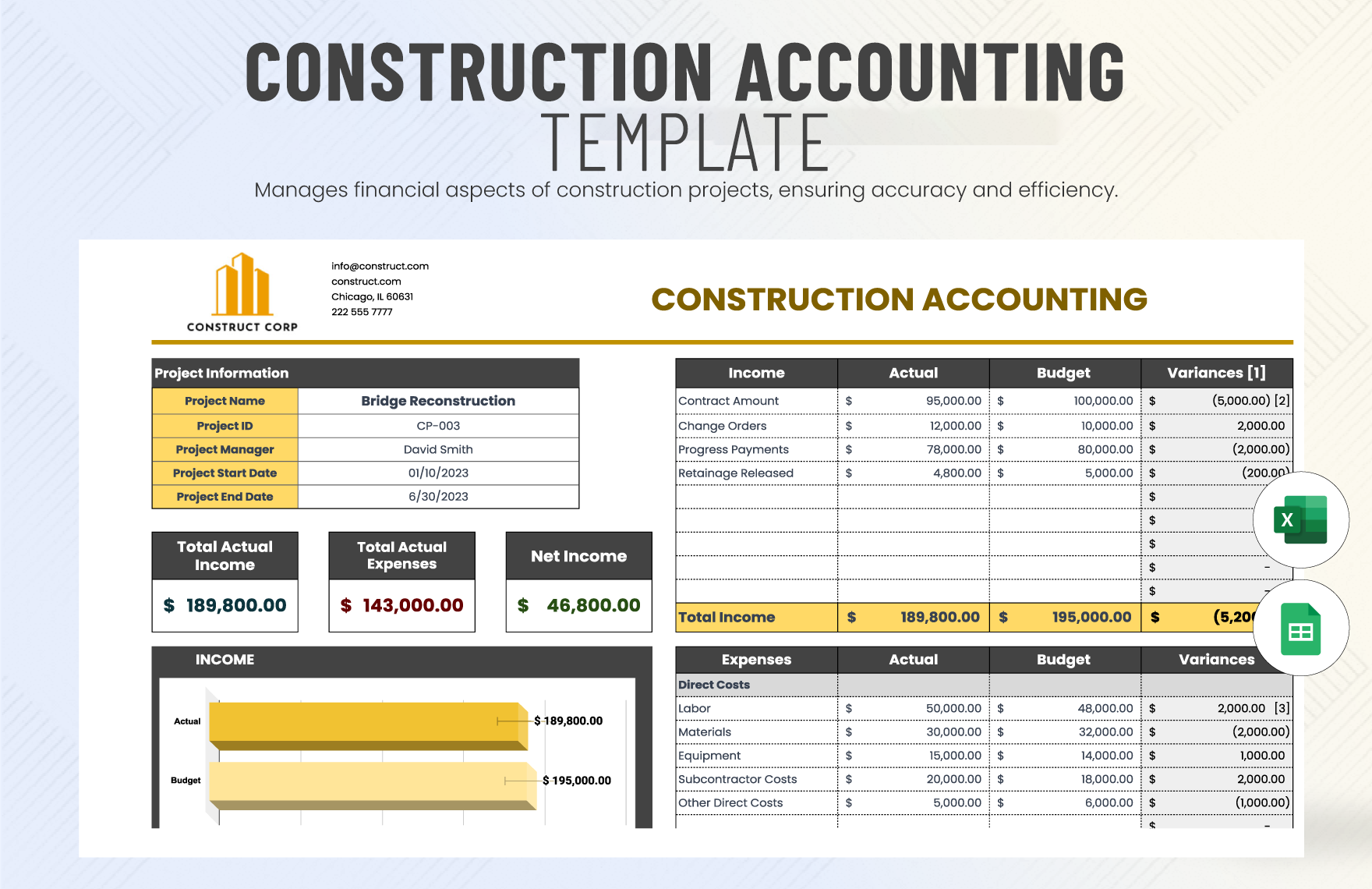

Successful building and construction bookkeeping depends not only on the right devices and software yet also on the execution of best techniques for monetary monitoring. To attain efficient financial oversight, construction firms ought to focus on precise and routine project budgeting. This procedure involves breaking down job expenses right into thorough groups, which enables better monitoring and forecasting of expenses.An additional essential technique is maintaining a durable system for invoicing and capital administration. Prompt invoicing makes certain that payments are obtained promptly, while persistent cash money flow tracking assists prevent liquidity issues. Additionally, building companies should embrace a strenuous approach to task costing, analyzing the actual prices versus budgets to recognize differences and change strategies accordingly.

Moreover, promoting openness with comprehensive economic reporting improves stakeholder depend on and help in educated decision-making. Normal financial reviews and audits can also reveal possible ineffectiveness and areas for renovation. Last but not least, constant training and advancement of financial management abilities among team make certain that the group continues to be skilled at navigating the complexities of building and construction bookkeeping. By incorporating these best practices, construction companies can improve their financial stability and drive project success.

Conclusion

In final thought, building and construction accountancy serves as a basic part of the building market, attending to distinct challenges and sticking to key principles that enhance monetary accuracy - construction accounting. By executing finest techniques, building and construction firms can cultivate stakeholder depend on and make informed useful source decisions, eventually contributing to the overall success and sustainability of tasks within the sector.Building and construction accountancy not just ensures the precision of monetary coverage however also plays a crucial duty in task administration by enabling reliable job costing and source allowance. Additionally, building and construction accounting emphasizes the relevance of conformity with accountancy requirements and guidelines, such as GAAP, to make certain transparency and reliability in financial reporting.

Effective building accounting counts not just on the right devices and software however likewise on the execution of finest techniques for economic management. Continual training and advancement of monetary administration abilities amongst team make certain that the team continues to be adept at browsing the complexities of building and construction accounting.In conclusion, building and construction bookkeeping serves as a fundamental part of the building market, dealing with one-of-a-kind difficulties and adhering to essential principles that boost economic accuracy.

Report this wiki page